<=Back

<=Craft Certificate in Human Resource Management Module II Business Finance Past paper July 2017

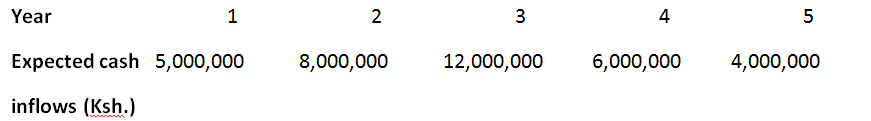

Magnet Ventures has borrowed Ksh. 20,000,000 from a bank at an interest rate of 14% per annum, which it intends to invest in a project. The following are the expected cash inflows from the project.

(i) Calculate the Net Present Value (NPV) at:

(I) 14%

(II) 32%.

(ii) Using the results in (i) above, determine the Internal Rate of Return (IRR) of the project.

(iii) Advise the management on whether to

(i) Calculate the Net Present Value (NPV) at:

(I) 14%

(II) 32%.

(ii) Using the results in (i) above, determine the Internal Rate of Return (IRR) of the project.

(iii) Advise the management on whether to

Viewed: 387 times

For Better experience and learning,for video answers, after video ends playing, click next question in the questions list!!!

Share in:

Questions List:

1. State three uses of cost of capital in business management

2. Outline three uses of financial ratios to the management of any business organization.

3. Highlight three advantages of investment appraisal to a business

4. State three types of costs associated with holding stock in a business.

5. Nyungu Limited intends to invest Ksh. 6,000,000 in a project. The present values of the expected cash inflows for a period of 4 years are as follows:

6. Karim deposited Ksh. 100,000 in a bank account for a period of 4 years at a compound interest rate of 8% per annum. Determine the amount in his account at the end of the 4 years.

7. Outline three functions of financial intermediaries in an economy.

8. State three external sources of finance to a business organisation.

9. Outline three assumptions of the Economic Order Quantity (EOQ) model

10. . Highlight three differences between preference shares and ordinary shares, as sources of business finance.

11. Explain four features of venture capital.

12. Outline six factors which may determine working capital requirements of a firm.

13. Explain four functions of merchant banks.

14. Magnet Ventures has borrowed Ksh. 20,000,000 from a bank at an interest rate of 14% per annum, which it intends to invest in a project. The following are the expected cash inflows from the project. (i) Calculate the Net Present Value (NPV) at: (I) 14% (II) 32%. (ii) Using the results in (i) above, determine the Internal Rate of Return (IRR) of the project. (iii) Advise the management on whether to

15. The following information relates to Material B28 used by Mamba Limited. Calculate each of the following: (i) Re-order level; (ii) Minimum stock level; (iii) Maximum stock level; (iv) Average stock level.

16. Explain the use of each of the following ratios in making business decisions: (i) Return on capital employed; (ii) Net assets turnover, (iii) Current ratio; (iv) Gearing ratio.

1. State three uses of cost of capital in business management

2. Outline three uses of financial ratios to the management of any business organization.

3. Highlight three advantages of investment appraisal to a business

4. State three types of costs associated with holding stock in a business.

5. Nyungu Limited intends to invest Ksh. 6,000,000 in a project. The present values of the expected cash inflows for a period of 4 years are as follows:

6. Karim deposited Ksh. 100,000 in a bank account for a period of 4 years at a compound interest rate of 8% per annum. Determine the amount in his account at the end of the 4 years.

7. Outline three functions of financial intermediaries in an economy.

8. State three external sources of finance to a business organisation.

9. Outline three assumptions of the Economic Order Quantity (EOQ) model

10. . Highlight three differences between preference shares and ordinary shares, as sources of business finance.

11. Explain four features of venture capital.

12. Outline six factors which may determine working capital requirements of a firm.

13. Explain four functions of merchant banks.

14. Magnet Ventures has borrowed Ksh. 20,000,000 from a bank at an interest rate of 14% per annum, which it intends to invest in a project. The following are the expected cash inflows from the project. (i) Calculate the Net Present Value (NPV) at: (I) 14% (II) 32%. (ii) Using the results in (i) above, determine the Internal Rate of Return (IRR) of the project. (iii) Advise the management on whether to

15. The following information relates to Material B28 used by Mamba Limited. Calculate each of the following: (i) Re-order level; (ii) Minimum stock level; (iii) Maximum stock level; (iv) Average stock level.

16. Explain the use of each of the following ratios in making business decisions: (i) Return on capital employed; (ii) Net assets turnover, (iii) Current ratio; (iv) Gearing ratio.