<=Back

<=Craft Certificate in Human Resource Management Module II Business Finance Past paper July 2019

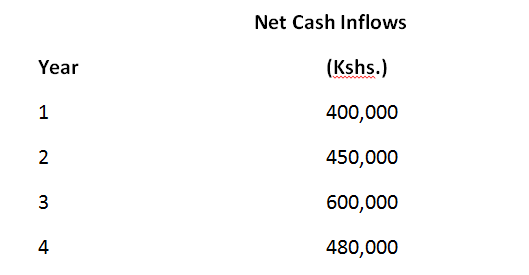

The following information shows the net cash inflows of Tambako Limited

Initial investment Ksh. 2,000,000

Target return 30%

(a) Calculate the Accounting Rate of Return (ARR) of Tambako Limited.

(b) Using the result in (i) above, comment on the performance of the company

Initial investment Ksh. 2,000,000

Target return 30%

(a) Calculate the Accounting Rate of Return (ARR) of Tambako Limited.

(b) Using the result in (i) above, comment on the performance of the company

Viewed: 332 times

For Better experience and learning,for video answers, after video ends playing, click next question in the questions list!!!

Share in:

Questions List:

1. Outline two differences between debentures and retained earnings, as sources of business finance

2. Highlight two services rendered by commercial banks to their customers.

3. 3. The following information relates to Waka Limited for the last quarter of the year 2017. Ordinary share capital 200,000 at Kshs. I each Net profit after tax Kshs. 1,000,000 Ordinary share dividend paid Kshs. 400,000 Market price per ordinary share Kshs. 20 Using the information above, calculate each of the following ratios: (i) Dividend per share; (ii) Earnings per share; (iii) Dividend

4. State two types of policies that may be used in the management of credit in an organization.

5. The following information shows the net cash inflows of Tambako Limited Initial investment Ksh. 2,000,000 Target return 30% (a) Calculate the Accounting Rate of Return (ARR) of Tambako Limited. (b) Using the result in (i) above, comment on the performance of the company

6. John intends to buy a car in three years' time, at a cost of Ksh. 1,000,000. At the beginning of the first year, he deposited Ksh. 300,000 in a bank, which pays compound interest at the rate of 10% per annum. At the beginning of the second year, he deposited Ksh. 400,000 in the same bank. Calculate the amount John should deposit in the bank at the beginning of the third year to e enable him buy

7. Outline the relationship between business finance and each of the following disciplines: (a) Financial Accounting: (b) Economics.

8. Sigmo Limited has ordinary share capital of Ksh. 1,000,000 with a par value of Ksh. 20 per share. The ordinary shares are currently selling at Ksh. 35 each. The company paid ordinary share dividends totalling Ksh. 100,000 during a particular year. Calculate the cost of equity of the company.

9. Explain four functions of merchant banks

10. Kesta Limited intends to borrow Ksh. 4,000,000 to finance either project X or project Y. The following are the expected net cash inflows for each project:i) culate the payback period for each project. ii) Based on the results in (i) above, advise the management on the project to invest in

11. Outline four factors which influence the choice of finance for a business

12. The following is the capital structure of Nakum Ventures Limited. Ksh. 100,000 ordinary shares of Ksh. 20 each 2,000,000 Retained earnings 800,000 12% preference shares of Ksh. 10 each 1 ,000,000 13% debentures 900,000

13. The following information relates to material B24 of a firm. Maximum consumption 7,500 units Minimum consumption 3,400 units Lead time 2-4 weeks Economic Order Quantity 10,500 (EOQ) Calculate each of the following: (i) Re-order level; (ii) Minimum stock level; (iii) Maximum stock level; (iv) Average stock level.

1. Outline two differences between debentures and retained earnings, as sources of business finance

2. Highlight two services rendered by commercial banks to their customers.

3. 3. The following information relates to Waka Limited for the last quarter of the year 2017. Ordinary share capital 200,000 at Kshs. I each Net profit after tax Kshs. 1,000,000 Ordinary share dividend paid Kshs. 400,000 Market price per ordinary share Kshs. 20 Using the information above, calculate each of the following ratios: (i) Dividend per share; (ii) Earnings per share; (iii) Dividend

4. State two types of policies that may be used in the management of credit in an organization.

5. The following information shows the net cash inflows of Tambako Limited Initial investment Ksh. 2,000,000 Target return 30% (a) Calculate the Accounting Rate of Return (ARR) of Tambako Limited. (b) Using the result in (i) above, comment on the performance of the company

6. John intends to buy a car in three years' time, at a cost of Ksh. 1,000,000. At the beginning of the first year, he deposited Ksh. 300,000 in a bank, which pays compound interest at the rate of 10% per annum. At the beginning of the second year, he deposited Ksh. 400,000 in the same bank. Calculate the amount John should deposit in the bank at the beginning of the third year to e enable him buy

7. Outline the relationship between business finance and each of the following disciplines: (a) Financial Accounting: (b) Economics.

8. Sigmo Limited has ordinary share capital of Ksh. 1,000,000 with a par value of Ksh. 20 per share. The ordinary shares are currently selling at Ksh. 35 each. The company paid ordinary share dividends totalling Ksh. 100,000 during a particular year. Calculate the cost of equity of the company.

9. Explain four functions of merchant banks

10. Kesta Limited intends to borrow Ksh. 4,000,000 to finance either project X or project Y. The following are the expected net cash inflows for each project:i) culate the payback period for each project. ii) Based on the results in (i) above, advise the management on the project to invest in

11. Outline four factors which influence the choice of finance for a business

12. The following is the capital structure of Nakum Ventures Limited. Ksh. 100,000 ordinary shares of Ksh. 20 each 2,000,000 Retained earnings 800,000 12% preference shares of Ksh. 10 each 1 ,000,000 13% debentures 900,000

13. The following information relates to material B24 of a firm. Maximum consumption 7,500 units Minimum consumption 3,400 units Lead time 2-4 weeks Economic Order Quantity 10,500 (EOQ) Calculate each of the following: (i) Re-order level; (ii) Minimum stock level; (iii) Maximum stock level; (iv) Average stock level.